Duolingo - An Investment Analysis

If you haven’t yet had a chance to read or watch the Duolingo breakdown, check it out! Here’s an embed from YouTube:

Today we’ll be discussing the moat Duolingo has along with a bull and bear case for investing. The model, for anyone interested in playing around with their own scenarios is available for those that subscribe to the newsletter. You can find it at the bottom of this page.

Duolingo’s Moat

Buffett was an early inspiration for me, and he’d describe a moat as a company's enduring competitive advantage that protects its profits and market share from competitors, similar to how a medieval castle's moat protected it from attackers.

Coca-Cola’s moat is its brand. Apple’s moat is excellent integration of its software and hardware. Disney’s is nostalgia. So what about Duolingo?

“Counter-positioned efficiency.”

Counter-positioning is when a newcomer adopts a business model that incumbents can't copy without shooting themselves in the foot. Duolingo didn't just beat Rosetta Stone; they made Rosetta Stone's business model (selling $300 CD-ROMs) obsolete.

There are three pillars of the Duolingo gameplan that tie together to reinforce this.

Pillar one: The “Unhinged” Cost Advantage

We discussed in the breakdown that Duolingo’s customer acquisition cost is significantly less than its competitors.

Most education companies have to spend $50 on ads to grab that $100 customer. Marketing is a grind.

Duolingo, on the other hand, effectively spends $0 to acquire millions of users. Their mascot is an internet celebrity, and their product is viral by design (streaks).

In Q3 2025, Duolingo spent just 12.9% of revenue on Sales & Marketing. Competitors like Coursera and Udemy often spend 30% to 40%. This gives Duolingo a structural margin advantage. They can pour that saved money into R&D (making the product better) while competitors burn cash just to stay alive.

Pillar 2: Data

Duolingo users complete over a billion exercises every day. This creates a data feedback loop that no startup can easily replicate.

“Birdbrain,” Duolingo’s proprietary AI model, predicts exactly when you are about to quit. It then serves you with easier lessons that give you that quick dopamine hit to keep you engaged.

You can copy the Duolingo UI. You can copy the mechanics. You can’t copy 10 years of data that create invisible personalization.

Pillar 3: Switching Costs

Ok... there’s no actual “cost” here, switching is free monetarily. But, there’s a psychological cost.

That 400-day streak? You’re not giving it up to go sign up to a Babbel account.

Switching apps means all of your progress is gone. It means admitting you wasted a year or more. This sunk cost fallacy locks users in tighter than an annual contract with Adobe. In software we look for that “data lock-in.” Duolingo has an “emotional lock-in.”

The Bull Case

Duolingo has a number of paths towards success. In order of value:

- Pricing Power

- Margin expansion

- Better free user monetization

- AI Proctored exams

Pricing Power

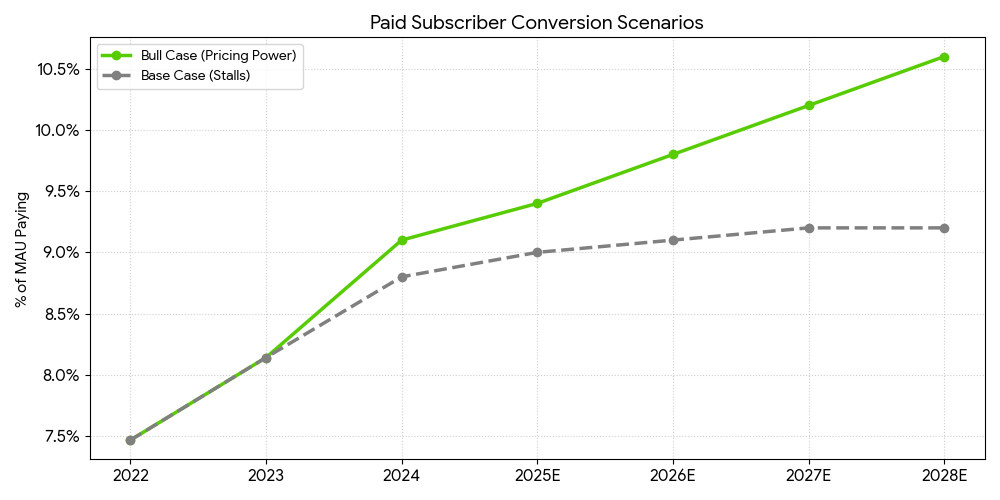

Currently less than 9% of users pay for Duolingo. You can use it for free, and there’s no obligation to pay. But, when you look at other companies with a similar model, Duolingo has a lot of headroom to increase conversion.

Spotify, as another publicly traded example, has a conversion rate of around 40%. Getting to 40% would be extraordinary. That alone would 5x Duolingo stock, but it’s not necessary to bring investors a huge windfall, 10.5%-20% would be perfectly fine.

In fact, in the downloadable model, where the bull case provides a 100% return, I only scaled conversion up to 10.6% by 2029. As the product gets smarter, and offers more, there’s better chances and more reasons to get users to convert.

Margin Expansion

The “Apple Tax.” If you subscribe to an app on the Apple App Store, the company you’re buying from pays Apple a commission. Duolingo is trying to move away from this, and if they can it stands to expand gross margins quite a bit.

That “tax” is 15-30%. If Duolingo can start converting users outside the app stores, gross margins grow for free. Instead of the 15% to Apple it’d be 3% to their payment processor. In the model we take gross margins from the ~73% today up to 78% by 2029.

On the operating margin side of things, sales and marketing is something that DUOL will spend more on over time, but that will come down as a percentage of revenue. The all-star 12% today could become a top-of-class 8.5% over the coming years with top-line growth.

Better Free User Monetization

This one falls lower down the list because Duolingo have previously stated they don’t want to go too hard on ads for fear of scaring users away. It makes sense.

Given that they make so little today from ads though, and given there’s a lot of headroom available, it’s worth calling out.

Back to Spotify as a comp as they run ads for their free users. Their ARPU on ads is $4.70 globally. Duolingo today is around $0.60. Duolingo has less inventory than Spotify, but it wouldn’t be unreasonable to get ad ARPU to to $2.50 if DUOL really wanted to.

I also think there’s a lot of opportunities here for branded courses and lessons.

Would airlines or hotels provide air miles for finishing lessons? Or maybe fictional languages could be sponsored as a fan engagement tool (there’s already Klingon and High Valyrian in Duolingo).

Robinhood, Visa, or Stripe could work with DUOL on financial literacy modules. Robinhood is looking to play a big role in Invest America, there’s significant opportunity here for a branded crossover.

Advertising need not be boring interstitials. Duolingo has a huge audience, and has a unique way to provide that huge audience with free, branded materials that they collect a toll for delivering. It’s high-intent, sponsors would love it.

AI Proctored Exams

The Duolingo English Test might be seeing some declines, but the technology that has been built could be expanded elsewhere.

In the United States alone there are thousands of educational institutions and professional certification bodies that facilitate millions of in person tests. Utilizing the AI proctoring built by DUOL the test taking experience could be better, and the cost to the taker reduced.

It’s not as fun and shiny as the consumer app we’ve spoken about throughout, but these tests generally cost a lot and people are usually “forced” to take them for careers, immigration, and educational purposes.

The bull case doesn’t drag DET (and any expansion) out too far which leaves plenty of valuation room should Duolingo push dramatically into this space.

Model Summary

The big hits are:

- An expansion of gross margin thanks to moving away from the “Apple Tax”

- Premium penetration growth thanks to content library

- Branded content and ad expansion for stronger “free” user monetization

Depending on your choice of valuation, we find an average price under these conditions of ~$400/sh. This would provide more than 100% growth over today’s price. And, if you believe I’m sandbagging a bit, which could be argued to be the case, there’s the chance that DUOL could one day head towards $1k/sh.

To get to $1k, they’d need to keep user growth going and get a premium penetration around 20%. Doable? Yes.

Base Case

In our Base case, we assume that Duolingo is... mortal.

The viral loops that drove them to 100 million users start to hit friction. The "easy" users (the ones who really wanted to learn Spanish) are already on the app. Now, they have to fight for the casuals.

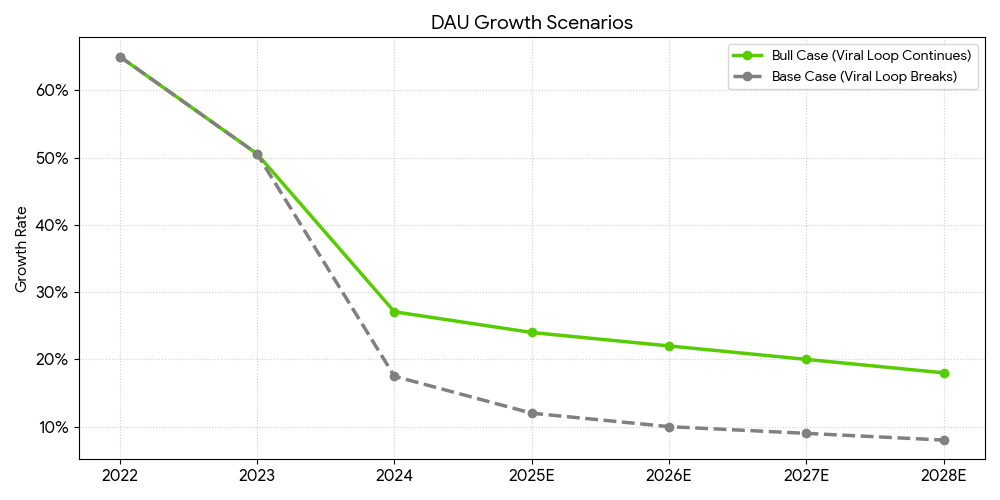

In the model, we drag DAU growth down from the stratospheric 40% levels we’ve seen recently to a pedestrian 8% by 2029. We also assume that paid conversion hits a ceiling. They’ve done a great job getting to ~9%, but in this scenario, we assume they struggle to push it meaningfully higher, stalling out at roughly 9.2%.

If this happens, the "growth premium" evaporates. The stock re-rates from a high-flying tech multiple to a standard media multiple (20-25x earnings). The result? The stock basically goes nowhere. The model spits out a fair value between $117 and $147 per share. You don't lose your shirt, but you miss the broader market rally.

The difference between the stock going nowhere and doubling comes down to two lines. If the 'Viral Loop' breaks, we follow the grey line. If the 'Unhinged' marketing keeps working, we follow the green.

The same applies to monetization. Can they convince 10% of users to pay? Or are we stuck at 9%? The gap between these two outcomes is worth $5 billion in market cap.

Even More Bearish

We touched on this in the breakdown, but it bears repeating. The existential threat to Duolingo is not Rosetta Stone; it is Google Translate.

A bearish outlook for Duolingo assumes the “utility” argument wins. People stop learning languages because technology solves the problem for them. If that becomes the case:

- DET revenue collapses as universities switch to generic AI assessments.

- Churn spikes as users realize they don't need to learn French for their trip to Paris.

- Margins contract as they are forced to spend heavily on marketing to replace lost users.

In this scenario, the DCF value drops to ~$77/sh, a haircut of over 50% from today's prices. While a complete collapse of language learning isn't fully modeled, this $77 level acts as a 'hard floor' valuation if growth stalls completely.

Closing Thoughts

Duolingo is a Rorschach test for how you view the future of humanity.

If you believe that AI will automate away the need for human knowledge, Duolingo is a zero.

But, if you believe that human nature is fundamentally about connection, status, and self-improvement, then Duolingo is one of the most exciting companies in the market. They are building a monopoly on "productive screen time." In a world where every other app is trying to rot your brain, Duolingo is the only one you pay to make you feel smart.

Is it a buy?

There are three things that make a starter position (1-2%) in Duolingo worthwhile:

- The “unhinged” moat is real: Finding a company with 40% revenue growth that spends only 13% on marketing is rare. This is a "Rule of 40" monster. Most SaaS companies burn 40% on sales just to grow 20%. Duolingo grows organically. That free cash flow potential is enormous.

- The monetization headroom is massive: The Bull Case model shows what happens if conversion hits just 10-12%. That is a conservative ceiling. If they unlock "B2B" (Schools/Universities) or "Family Plans" at scale, they could double revenue without adding a single new user.

- The "Founder Mode" Factor: Luis von Ahn is a killer. He isn't a "Manager"; he's a Founder. The decision to cut contractors for AI proves he will protect margins over PR. That is what you want in a CEO during a technological shift.

The verdict: if you’re a buyer, be a patient one. We will add DUOL to the TechBreakdowns portfolio as a tracking position and continue to keep subscribers updated.

TL;DR:

- Downside Risk: ~$77 (Stock drops ~60%)

- Upside Potential: ~$400 (Stock doubles)

Necessary Disclaimer:

This newsletter is not financial advice. It is for educational and entertainment purposes only. I am not a registered investment advisor. The content here reflects my personal views and the "TechBreakdowns portfolio" is a hypothetical or tracking portfolio for demonstration purposes.

The author may hold positions in any security mentioned.

Member discussion