How Rocket Lab Beat Commoditization (And Your Business Can Too)

Rocket Lab could have stopped with its Electron rocket, but a strategic dead-end was forming. While Electron dominated the dedicated small launch market, SpaceX's Transporter (rideshare) program was aggressively commoditizing access to orbit, driving down prices for everyone.

It was a 'race to the bottom,’ the kind that kills thousands of startups.

Peter Beck and the team realized that competing on launch price alone was a losing battle. They saw a critical bottleneck: their customers were great at data, but not all were great at building space hardware. Instead of dying, they initiated a brilliant pivot.

They realized the true, high-margin opportunity was not just in launching satellites, but in building them. This shift transformed their business from a 'launch feature' into an 'end-to-end space platform'.

Today, all you need is a space idea and some money, and Rocket Lab can handle the rest. They design spacecraft, manufacture them, launch them, and provide in-space services.

This breakdown covers the five standout actions Rocket Lab took and the lessons you can apply to your own business.

Lesson 1: Escape the Commoditization Trap by Owning the Value Chain

From the outside, Rocket Lab looks like a rocket company. But launch is no longer the part of the business that will drive its future growth. That "thing" is Space Systems.

This division is a two-pronged attack:

1. Pillar 1: Supplying the Industry (A La Carte)

Starting in 2020, Rocket Lab began acquiring market leaders in key, high-margin, and hard-to-build space components. This hardware is sold to the entire industry, even competitors. Key acquisitions include:

- Sinclair Interplanetary (2020): A leader in reaction wheels (for pointing) and star trackers (for navigation). These are five or six-figure components critical for any satellite.

- Planetary Systems Corporation (PSC) (2021): A market leader in satellite separation systems.

- Advanced Solutions (ASI) (2021): The "brains" of a mission, providing flight software for guidance, navigation, and control.

- SolAero Holdings (2022): A top producer of high-efficiency, space-grade solar cells and panels.

2. Pillar 2: The All-in-One Solution (Pre-Fixe)

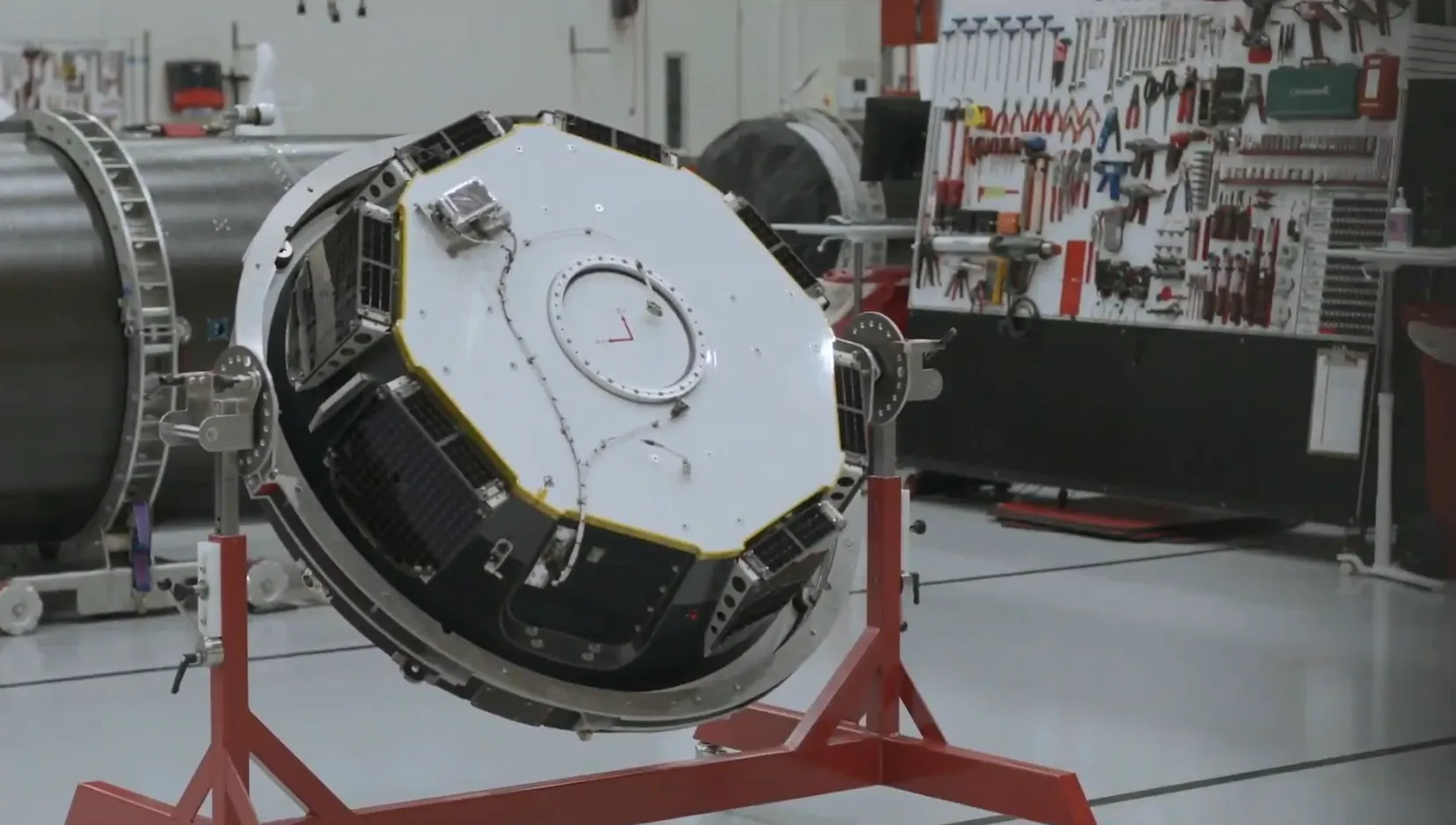

For customers who don't want to build a satellite themselves, Rocket Lab acts as the prime contractor. It takes all those high-tech components from Pillar 1 and integrates them into its proprietary 'Photon' bus to deliver a flight-ready spacecraft.

This "Done-for-You" tier comes in several "classes" for different missions:

- Photon (LEO): The standard for Earth-orbit missions.

- Explorer-class: For deep space and interplanetary capabilities (used for NASA's CAPSTONE).

- Pioneer-class: A bespoke bus for unique missions (like Varda Space Industries' in-space manufacturing).

- Lightning-class: A larger bus for complex constellations, which won massive contracts from the U.S. Space Development Agency (SDA) and Globalstar.

The Takeaway: Rocket Lab saw the commoditization of launch and pivoted from 'just launching' to 'designing, building, and launching'. They now own the entire process.

Lesson 2: The 'Frenemy' Strategy – Monetize Your Competitors

This is the most brilliant part of the pivot. By selling high-margin components, Rocket Lab wins even when they lose a launch contract.

There are two perfect examples:

- Public (The Fact): NASA's EscaPADE mission will use Rocket Lab-built spacecraft, but it will launch on Blue Origin's New Glenn. Rocket Lab still wins by supplying the high-margin solar panels, star trackers, and radios.

- Speculative (The Rumor): There is strong speculation that Rocket Lab is the chief supplier of reaction wheels for Amazon's Leo. Leo is a massive constellation that will also launch with Blue Origin (and others).

The Takeaway: Ask your team: What 'internal tool' or 'component' have we built that is so good we could sell it to the entire industry? This is exactly how Amazon created AWS.

Lesson 3: Turn Your Cost Centers into Profit Centers

How did the Photon satellite platform come about? It started as a cost center.

Rockets typically have a "kick stage," a disposable third stage that does the final "push" to put a payload precisely in orbit. Rocket Lab engineers asked: why not add power, comms, and propulsion and make this single-use component a long-duration spacecraft?

That's how Photon was born. This pivot also spun out new, sellable products:

- Curie: A small, 3D-printed, restartable engine that gives Photon its in-space maneuverability.

- HyperCurie: A high-performance interplanetary version that was used on the CAPSTONE mission to send a spacecraft to the Moon.

The Takeaway: Rocket Lab took a cost of doing business and productized it. What are you 'throwing away' in your business? Data? Internal software? A specific process?

Lesson 4: Build the "Feature" That Earns You the Right to Pivot

To even have a kick stage to upgrade, Rocket Lab first had to master launch. They did this by innovating in manufacturing and propulsion.

Electron, its small-launch vehicle, was a testbed for groundbreaking ideas that have now flown over 70 times:

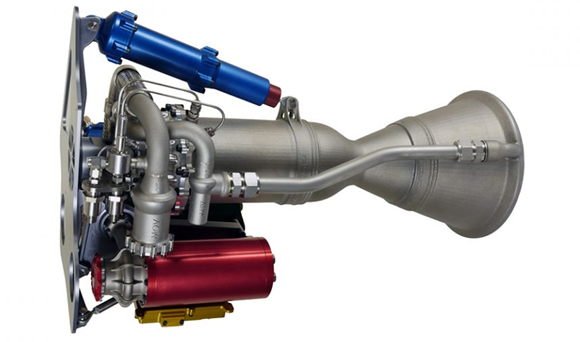

- Rutherford Engine: The world's first orbital-class rocket engine to use electric pumps. This makes it simpler and far more efficient (95% vs. ~50%) than traditional engines.

- Additive Manufacturing: All primary components of the Rutherford (combustion chamber, injectors, pumps) are 3D-printed, allowing Rocket Lab to manufacture an engine in about 24 hours.

- Robotic Assembly: "Rosie the Robot" can build Electron's carbon-composite body structures in 12 hours, a process that would take weeks manually.

The Takeaway: These innovations weren't just for show. They were the feature (a reliable, fast-to-build small rocket) that gave Rocket Lab the platform (a customer base, cash flow, and engineering credibility) to make its next move.

Lesson 5: Make the High-Stakes Bet to Own Your Destiny

This brings us to the final, most critical lesson. Why would Rocket Lab spend a fortune to build Neutron, a new medium-lift rocket, when they could just launch their Photon satellites on a SpaceX Falcon 9?

Because relying on your biggest competitor for a core part of your business is a strategic death trap.

This is Rocket Lab's all-in bet. Neutron isn't just an upgrade; it's the lynchpin for the entire "end-to-end" vision. This is where the Bull vs. Bear case for the company truly lies.

- The Bull Case: The high-margin Space Systems (Lessons 1-3) funds the Neutron build-out. Once Neutron is flying, Rocket Lab is the only company besides SpaceX that can offer a single, seamless contract: from a blank sheet of paper to a fully-operational constellation in orbit. This vertical integration is an iron-clad moat.

- The Bear Case: Execution risk. Neutron is a massive technical challenge, competing directly with the Falcon 9 monopoly. It's already behind schedule and burning cash. If Neutron fails—or is simply too late—the "end-to-end" vision collapses.

To win this bet, Neutron must be reusable and cheaper. Rocket Lab is de-risking it by:

- Applying lessons from Electron: Using advanced robotics and carbon fiber.

- Designing for reusability: Using a clean-burning Methane-based Archimedes engine.

- Solving a cost problem: Creating the "Hungry Hippo" fairing, which opens its mouth to release the payload and returns with the first stage, eliminating the $6M+ cost of a disposable fairing.

The Takeaway: Your "frenemy" strategy (Lesson 2) buys you time. Your core innovations (Lesson 4) buy you credibility. But to truly win, you eventually have to make the high-stakes bet to own your core dependencies.

Why This Matters

Rocket Lab isn't just surviving a price war; they are building a playbook on how to make a business antifragile. They proved that the best way to beat commoditization is to refuse to play the game.

Their pivot offers a powerful set of lessons for any founder, operator, product leader, or investor. The core of their strategy is this:

- Use high-margin, niche components (like reaction wheels) to fund your platform.

- Build an end-to-end platform (like Photon) to own the customer relationship.

- Make the high-stakes bet (like Neutron) to own your destiny and escape your competitors for good.

This is the strategic framework. The question for any business is how to apply it.

Member discussion